Emotions and behavioral biases often shape financial decisions more than we realize, influencing how we save, spend, and invest — especially during stressful times like tax season.

As we begin the year, reflecting on recent policy and market changes provides important context for the financial decisions and strategies that lie ahead.

Successful goal setting starts with clarity and simplicity. Using SMART goals, writing them down, sharing them for accountability, and celebrating small wins can help turn intentions into lasting habits. Making the process enjoyable keeps motivation strong and goals achievable all year long.

As the year draws to a close, it’s a valuable time to pause, review your financial picture, and take steps to finish strong. This guide outlines practical, time-sensitive strategies to consider before the holiday rush sets in—covering tax-loss harvesting, Roth IRA conversions, charitable giving, catch-up retirement contributions, estate planning, and 529 education savings.

Inherited IRA Rules Have Changed

Starting in 2025, most non-spouse beneficiaries must take annual withdrawals and fully deplete inherited IRAs within 10 years. These rules can impact taxes and estate plans, making professional guidance essential.

April marks a big moment for college-bound families. From financial aid letters to 529 plan withdrawals, it’s time to balance dreams with financial reality.

Professional Financial Advisors is thrilled to announce Brad Hisel as the Head of Business Development. With nearly a decade of experience in the industry, Brad is poised to make a significant impact on our team and our clients.

Many people lose track of old 401(k) accounts, with over 29 million unclaimed in the U.S. as of 2023. To find them, contact former employers, use online tools, or check with the Department of Labor. The new SECURE 2.0 Act will soon offer a searchable database to help locate lost accounts. Don't let your retirement savings go unclaimed.

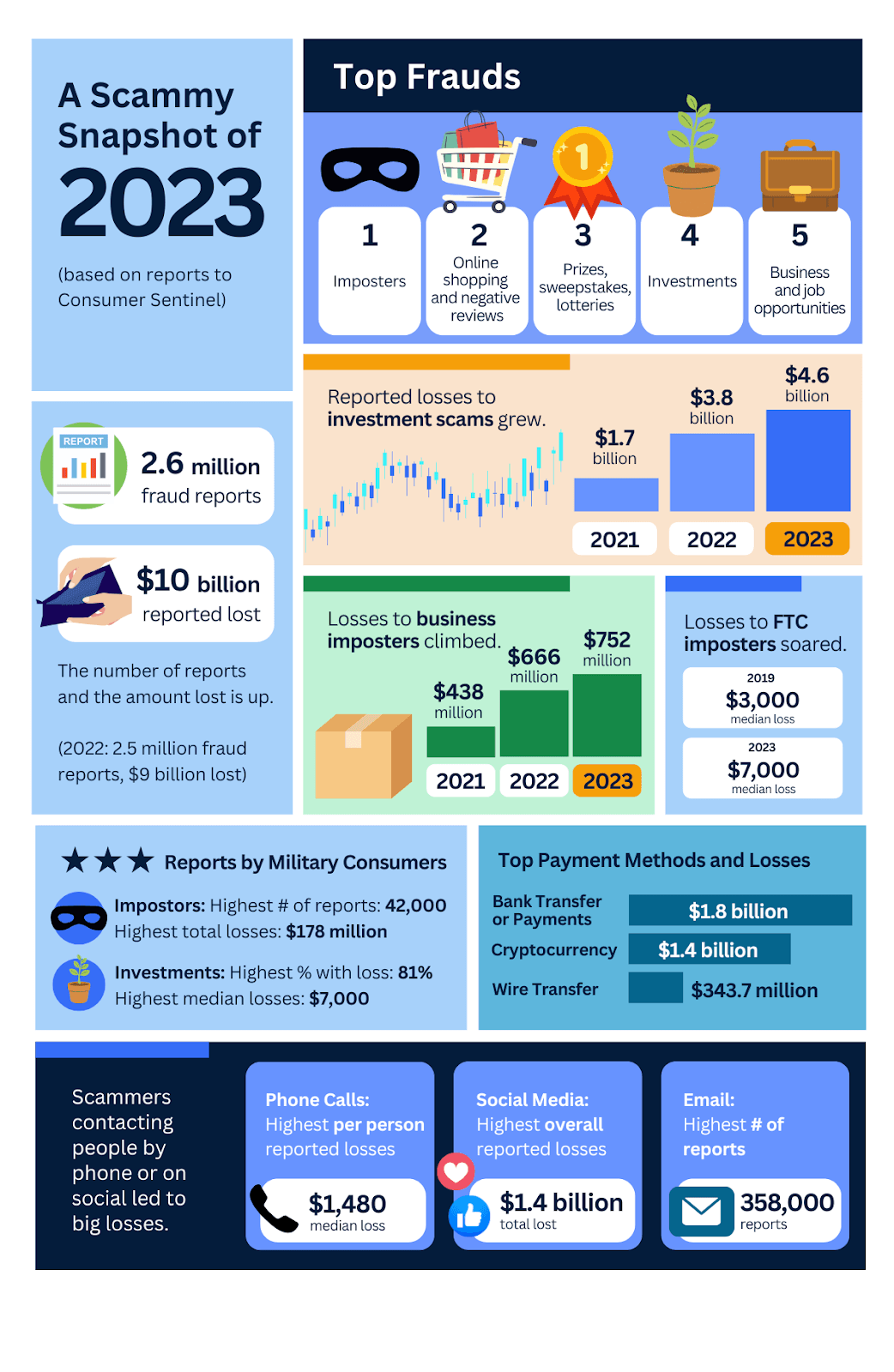

Tax season heightens identity theft risks, with criminals filing fake returns to claim refunds. Early filing and staying alert to scams can help protect you. If targeted, contact the IRS and consult a tax professional.

Social Security is a key part of retirement planning, offering benefits beyond retirement. Understanding factors like delayed claiming and taxes can improve your financial strategy.

Many Americans stick to resolutions like improving health and saving money. To stay on track, break goals into monthly tasks, use budgeting apps, stop bad habits, learn new skills, and review insurance. We’re here to help with your financial journey.

As 2024 ends, we reflect on key financial trends and look ahead to 2025, ready to guide you through upcoming opportunities and challenges.

As you approach retirement, healthcare costs become a key concern. Retirees face rising medical expenses and must navigate options like Medicare and private insurance. Proper planning is essential for a secure retirement.

This article suggests a year-end review that includes personal growth, health, and relationships, not just finances. By reflecting on achievements and setting goals, you can align your financial strategy with broader life aspirations for long-term well-being.

As the year wraps up, consider how to maximize your charitable contributions. This article highlights trends in giving and offers strategies like using IRAs, donor-advised funds, and charitable trusts. Learn how to select the right charity and make the most of your donations, both personally and tax-wise.

With 33% of Americans facing identity theft, protecting your information is essential. Here are quick strategies:

*Review statements for suspicious activity.

*Freeze your credit to block unauthorized access.

*Use unique passwords for each account.

*Shred sensitive documents.

*Limit personal items in your wallet.

Consider identity theft protection services, and act quickly if you suspect theft by placing fraud alerts on your credit reports

In December 2022, Congress passed the SECURE 2.0 Act. It introduced two new rules relating to 529 plans and student debt that will take effect in 2024. The first provision allows for tax- and penalty-free rollovers from a 529 plan to a Roth IRA. The second provision allows student loan payments made by employees to qualify for employer retirement matching contributions. The overall goal is to help young adults start saving for retirement.

The Inflation Reduction Act of 2022 provided the IRS with an influx of funding to modernize outdated technology and rebuild a depleted workforce. We discuss audit rates and the factors that can cause an individual to be chosen for an audit, as well as tips to help taxpayers avoid unwanted attention from the IRS. With a greater focus on compliance, now is the time to consult an experienced tax professional for personalized guidance.

Learn about the importance of keeping and managing your financial records, along with some helpful tips on what records to keep, how long to keep them, and how to store them securely. It also gives insight into creating a personal document locator and offers advice on how to properly dispose of sensitive documents.

Many Americans' moving towards retirement explore annuities, which is an investment strategy that is issued by an insurance company and designed to help protect you from the risk of outliving your income. Some annuity products can be particularly enticing for individuals who want guaranteed income benefits. These payments may start immediately or at a later time, depending on the stage of life you're in. An investor should conduct their own research to ensure they know what they are buying and understand the annuity contract's fine print, terms, and fees.

According to the Social Security Administration (SSA), approximately 70 million Americans currently collect some sort of Social Security retirement, disability, or survivor benefit. According to the SSA, Social Security is already paying out more money than it takes in. By drawing on the Social Security trust fund (OASI), the SSA estimates that Social Security should be able to pay 100% of scheduled benefits until fund reserves are depleted in 2034. While no one can say for sure what will happen, there are some solutions that have been proposed to help keep Social Security solvent for many years to come. No matter what the future holds for Social Security, your financial future is still in your hands. Focus on saving as much for retirement as possible, and consider various income scenarios when planning for retirement.

Massive computer hacks and data breaches are now common occurrences — an unfortunate consequence of living in a digital world. Now more than ever, it's important to safeguard yourself against identity theft. Here are some steps you can take to protect your personal and financial information.

On August 24, 2022, just a few days before federal student loan repayment was set to resume, President Biden announced a plan for additional student loan debt relief. The new plan will cancel $10,000 in federal student loan debt for individual borrowers whose income is below $125,000 ($250,000 for married couples) in 2020 or 2021, plus another $10,000 for Pell Grant recipients.

The latest mess out of Washington is the fight to increase the federal debt ceiling. If this isn’t resolved, some fear catastrophe for the markets. Stocks may dip at first, but a market debacle won’t happen. The debt ceiling fiasco will come and go, market volatility will likely increase and we have to manage our emotions and follow our investment discipline.

We’re all busy. There is always some new item on our constantly growing to-do lists. Some tasks are fun to take on others are tedious, boring, long or all the above...

Don’t let disorganization become one of your biggest money problems...

The Fair Credit Reporting Act of 1970 has stood the test of time, and the Consumer Credit Reporting Reform Act has provided additional protection to the American consumer...

The US Department of Agriculture released the 2015 Expenditures on Children by Families Report with the scary title...