Receiving a bonus, inheritance, or income boost often sparks a key financial question: Is it smarter to pay off your mortgage or invest the extra cash?

This blog post explores the importance of holding equities for the long term, and the strategies that can help you remain disciplined and protect yourself from market volatility. Warren Buffett's words of wisdom remind us that sometimes the best move is to stay put and ride out the storm, while having cash on hand and an understanding of why you own certain stocks can help you make smart decisions. Read on to learn how to craft an approach that works for you.

According to the Social Security Administration (SSA), approximately 70 million Americans currently collect some sort of Social Security retirement, disability, or survivor benefit. According to the SSA, Social Security is already paying out more money than it takes in. By drawing on the Social Security trust fund (OASI), the SSA estimates that Social Security should be able to pay 100% of scheduled benefits until fund reserves are depleted in 2034. While no one can say for sure what will happen, there are some solutions that have been proposed to help keep Social Security solvent for many years to come. No matter what the future holds for Social Security, your financial future is still in your hands. Focus on saving as much for retirement as possible, and consider various income scenarios when planning for retirement.

Understandably, many people put off planning for long-term care. But although it's hard to face the fact that health problems may someday result in a loss of independence, if you begin planning now, you'll have more options open to you in the future.

Long-term care refers to a broad range of medical and personal services designed to assist individuals who have lost their ability to function independently. Long-term care may be divided into three levels; skilled care, intermediate care, and custodial care. Although long-term care can be provided in a number of places, long-term care insurance policies sometimes limit the facilities where you can choose to receive long-term care.

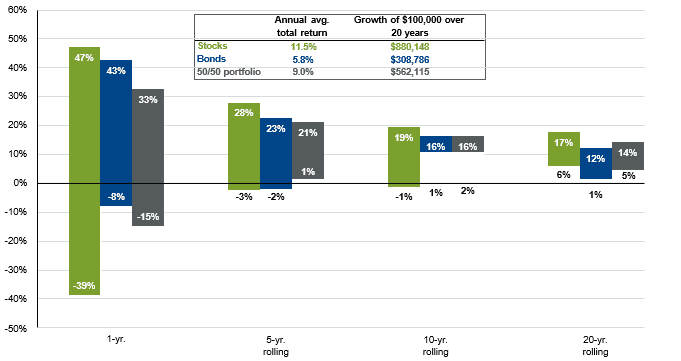

Owning a home outright is a dream that many Americans share. Having a mortgage can be a huge burden, and paying it off may be the first item on your financial to-do list. Deciding between prepaying your mortgage and investing your extra cash isn't easy, because each option has advantages and disadvantages. But you can start by weighing what you'll gain financially by choosing one option against what you'll give up. In economic terms, this is known as evaluating the opportunity cost.

On August 24, 2022, just a few days before federal student loan repayment was set to resume, President Biden announced a plan for additional student loan debt relief. The new plan will cancel $10,000 in federal student loan debt for individual borrowers whose income is below $125,000 ($250,000 for married couples) in 2020 or 2021, plus another $10,000 for Pell Grant recipients.

On October 13th, the Social Security Administration announced a 5.9% COLA. A 5.9% COLA will increase the average Social Security payment for a retired worker by roughly $92 a month, making the average monthly benefit worth $1,657.

COVID-19 has presented everyone with incredible challenges as it has wreaked havoc on our country and around the world...

“There’s a time and place for everything.” You’ve probably heard that expression a bunch of times...

Preparing a child for college may be a rewarding, but worrisome, time for you and your family...

In difficult economic times, many young couples and families may find themselves wondering where their money goes...

However much you make or save now doesn’t promise you a bright financial future. Life is unpredictable...

Asking questions and planning will give you both peace of mind...

Today, many people are concerned about saving for retirement or paying for a large ticket item, such as a child’s college education...

Maybe you have just married, or are starting a family. Or, perhaps you simply feel the need for a financial checkup and a strategy to help you start saving for retirement or your child’s education...